Learning Objectives

After reading this section, students should be able to …

- conduct a preliminary screening to select countries to enter

- conduct a Country Attractiveness Analysis to select countries to enter

- make the final selection of countries to enter

In this section, we introduce a new tool, the ‘Country Attractiveness Analysis (CAA)’, which provides in-depth screening models for selecting and entering foreign markets. The process for evaluating foreign markets for potential entry typically consists of three stages – the Preliminary Screening stage, the in-depth screening page and the final selection.

Preliminary Screening

In the Preliminary Screening stage, potential countries are evaluated on macro-level indicators such as political stability, economic development, geographic distance, etc. The preliminary analysis can include one or more of the tools that were presented in the previous sections of this chapter – e.g., the PESTEL Analysis, the CAGE Analysis, and/or the Scenario Planning and Analysis.

Countries that pass through the preliminary screening process are then examined in more detail during the In-depth Screening stage. In the second stage, criteria specific to market success for the industry and product markets are identified, and countries are evaluated on them. The in-depth screening process is the core of country attractiveness analysis, since it brings to bear criteria that management feels are critical to business success. Because criteria must be relevant to industry and product market success factors, in-depth screening must be customized and updated.

Country Attractiveness Analysis

Step 1: The first step in conducting the CAA involves in identifying the criteria that are critical to business success. This will be different for different products. For example, the success factors for a toothpaste category would be Consumer Demand, Consumer Access to Supply, Competition, Distance, and Regulation. The specific criteria related to the ‘Consumer Demand’ of a toothpaste will be population, GDP per capita, GDP growth rate, inflation rate (the lower the better), toothpaste sales growth, toothpaste sales, etc. Similarly, the specific criteria related to the ‘Supply’ of a toothpaste will be sales-force expenses, average expenses (the lower the better), and distribution fixed costs (the lower the better). The specific criteria related to the ‘Competition’ factor for a toothpaste will be # of competitors, total marketing expenditures, # of MNCs, and largest competitor’s share, the lower the better for all these criteria.

Another example: a company whose niche is luxury goods sold through wholesalers to retail stores and on to end users may identify two important factors: level of affluence and distribution network. Criteria used to assess affluence could be disposable income, income growth, and GDP.

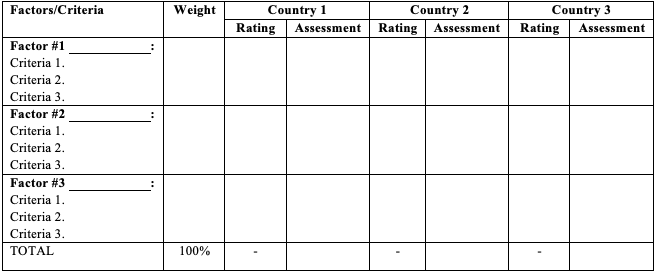

Step 2: The next step is to weight the importance of each criterion. Weighting each criterion is necessary since not all criteria are equally important. Obviously, criteria are selected because they meet some minimum threshold level of importance. Yet some criteria are more important than others, and these differences need to be taken into account. A common approach is to allocate 100 points (or 100%) across all of the criteria, where more points (or a higher percentage) are awarded to criteria that are more important. An ideal way to do this is to first assign weights to the factors so that the sum of all weights adds up to 100%, and then divide the weight of each factor among their criteria.

Step 3: Third, each country needs to be rated on each criterion. The rating is designed to determine how well a country performs or is characterized on a particular criterion. A common rating scale ranges from one to ten, where 1 = very poor and 10 = very good.

Step 4: Finally, calculate the ‘Assessment’ score for each country by multiplying the weight of each criteria and its rating.

Table 6.4 Steps in the CAA

| · Identify Factors and criteria

· Weight criteria (allocate 100 points or 100% across all criteria, where more points/percentage points are given to more important criteria) (Tip: Weight factors first) · Use available data to rate each market opportunity on each criterion. A 10-point scale, where 10 = excellent and 1 = poor can be used. · Multiply the criterion rating times the criterion weight to derive an assessment score for each criterion · Sum the criterion assessment scores within each factor to derive factor assessments. · Sum the factor (or criteria) assessment scores to derive an overall assessment for each market opportunity |

Final Selection

Based on the assessment scores calculated for each country, one or more countries can be selected for market entry. The results of the in-depth screening illustrate the relative attractiveness of the countries investigated. Before making investment decisions, due diligence analyses will be performed to better forecast costs, revenues, capital (financial, human) requirements, cash flow, expected rate of return, etc. These forecasts will likely differ depending on entry mode. As due diligence analyses are very complex and time consuming, an important contribution of in-depth screening is to narrow down the number of markets for due diligence analysis.

Table 6.5 In-depth screening calculations