79 9.3 GLOBAL, NATIONAL, REGIONAL, AND LOCAL PATTERNS

9.3.1 How Fast Does the Global Economy Grow and How Much Money Is There in the World?

How Fast Does the Global Economy Grow and How Much Money Is There in the World?

With 78 of the world’s more than 200 countries and territories categorized by the World Bank as high and 64 are low or lower middle income, it is tempting to believe that wealth distribution might be relatively balanced in the world. After all, more people than ever are connected to the global economy. Instead, inequalities have been exacerbated by global capitalism in recent years. Jeff Bezos, the founder of Amazon, has a net worth of $105 billion, a figure that is larger than the annual GDP of 150 countries! Meanwhile, 800 million people earn less than $2.00 per day. Such click-bait worthy headlines, while fascinating, can also be misleading. Thirty-five percent of the world lived in extreme poverty in 1990. By 2013 that figure dropped to 11%, representing a shift of nearly 1.1 billion people out of extreme poverty. Nonetheless, economic differences between most wealthy countries compared to most poor countries have widened over that same period rather than narrowed.

The number of those entering the formal economy rose dramatically during that time period, so categorizing somebody as not in ‘extreme poverty’ simply because they earn more than $2.00 a day is also quite problematic. The majority of those that rose out of extreme poverty were in just two countries (India or in China), where hundreds of millions of people left unpaid work on subsistence farms and moved to cities, where they earned just a little bit of money. Does that make a country more developed or a person better off? In economic terms, the answer is yes, but in more qualitative terms, the answer is not quite so clear.

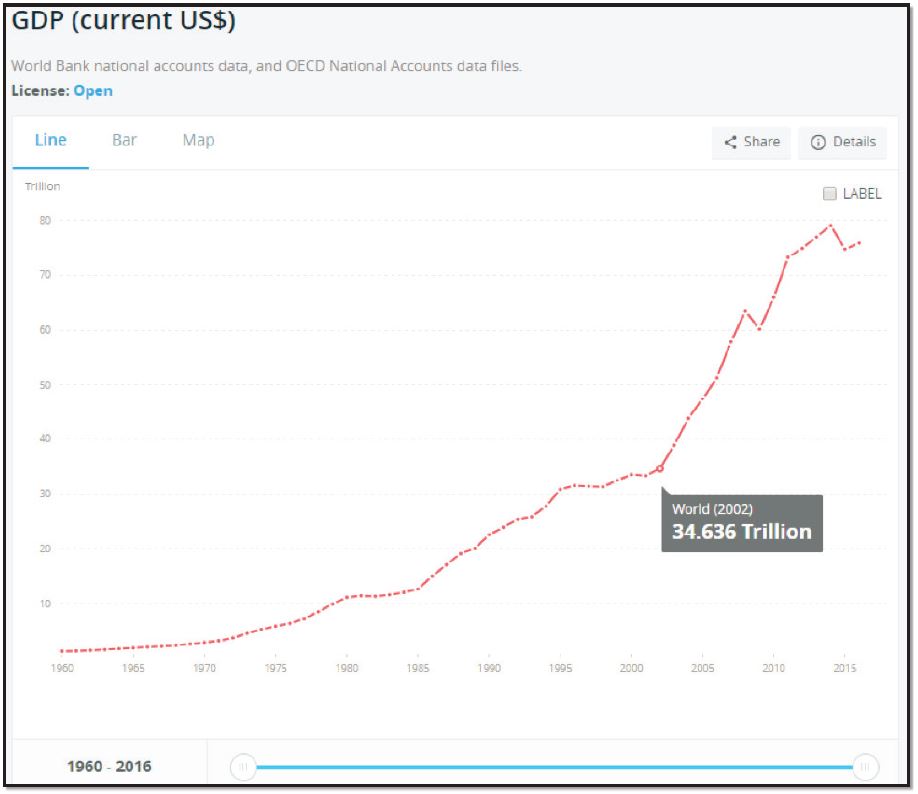

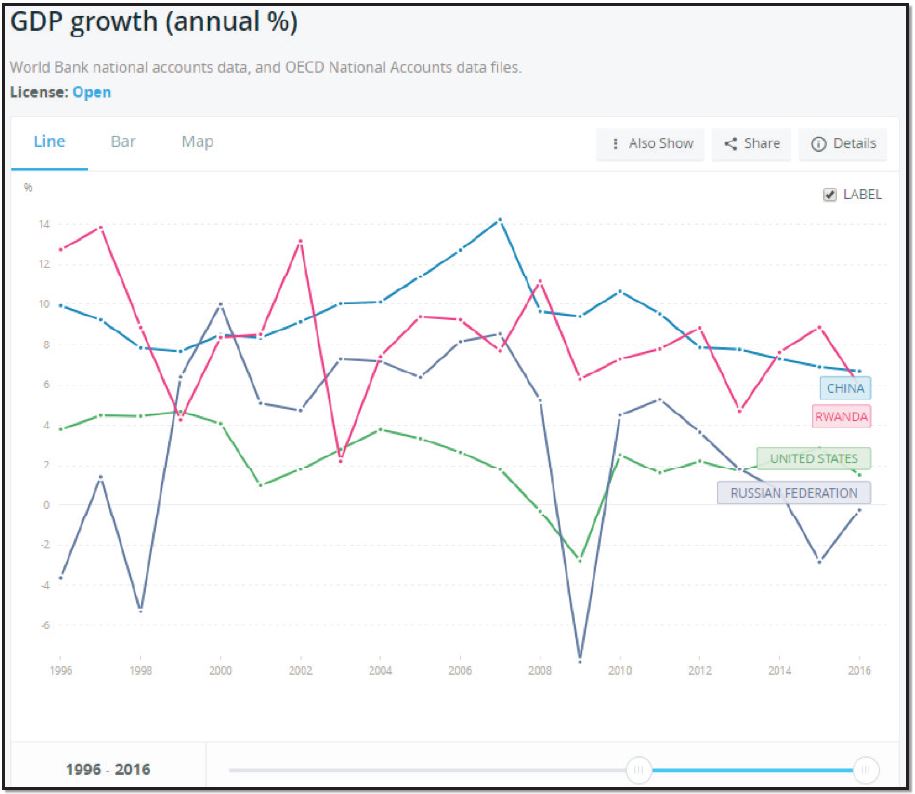

The global economy has grown persistently since 1960 as evidenced by Figure 9.5, with the most dramatic growth occurring since 2000. As a matter of fact, global GDP nearly doubled between 2002 ($34.6 trillion) and 2016 ($76 trillion)! So it took all of the economies of the planet tens of thousands of years to go from zero to $34 trillion, but then only 14 years to double that figure. Hmmm. Does this represent sustainable development – one that can continue into the future? Moreover, can the planet handle the effects of continued growth, consumption, CO2 emissions, and water pollution across the world at such a persistent growth rate? Such questions are difficult to assess and will be dealt with more substantially in the last chapter of this text. For now, it’s important simply to understand that economic growth is just one of many indicators used to understand development and well-being, and the implications for economic growth come with complications. Finally, economic growth across the planet is uneven and difficult to predict. In spite of what appears to be a fairly even upward movement in global GDP, one can see more clearly the complex nature of GDP growth in Figure 9.5 that shows the wild changes in growth that vary dramatically by place and time. In the 20 years from 1996-2016, Russia (an upper tier country) experienced many years of negative growth, while Rwanda (a lowest tier country) experienced rates of growth up to 14%, much higher than that of any other country. U.S. growth was negative in 2009 and has hovered around 2-3% in subsequent years. China’s annual growth, that had averaged 12% for several years dropped to around 7%, where it is expected to remain into the 2020’s.

Figure 9.5 | Gross Domestic Product 1960-2016 in current US$

Author | The World Bank

Source | The World Bank

License | CC BY 4.0

The most basic spatial patterns of wealth and income can be easily observed in the maps and figures presented thus far in this chapter. Wealthier countries tend to be those in the Global North (North America, Europe, Japan, Australia, New Zealand), while poorer countries tend to be in the Global South (everywhere else). However, such generalizations are problematic in truly understanding wealth and well-being around the planet. Let’s take a brief look at Latin America, for example. Mexico, by most accounts, is considered a developing country (another name for ‘less developed country’ that is on a pathway to improving). It falls south of the Brandt line, and is considered poor by most American standards. However, its per capita income places it in the top third of all countries and its economy is the 15th largest in the world. Carlos Slim, once the wealthiest person in the world, is Mexican and its economic performance far outpaces all of its neighboring countries to the south. The difference in economic indicators between Mexico and Haiti, for example, is greater than the difference between Mexico and the U.S. As such, it’s important to be wary of simplistic categorization schemes in terms of wealth and development.

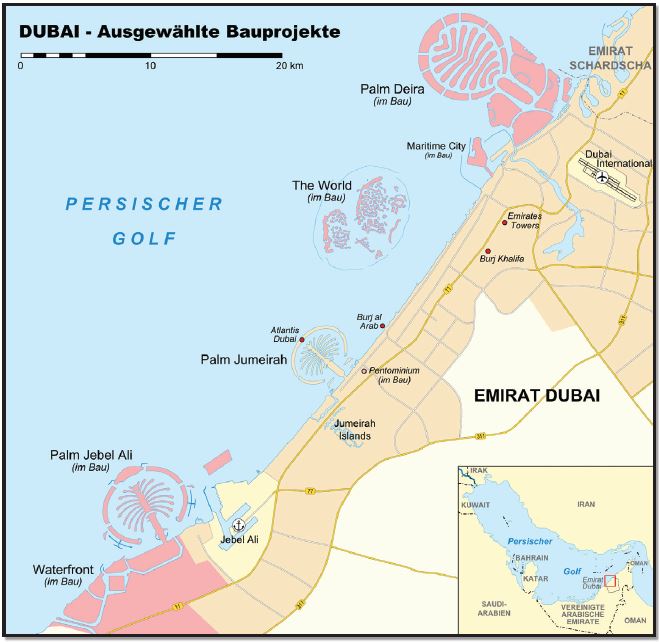

Moreover, in recent decades dozens of newly industrialized countries (NIC’s) have emerged that have reached or approached MDC status. Such places have moved away from agriculture-based economies to more industrial, service, and information-based systems. One example is a group of places known as the Asian Tigers or Asian Dragons (Singapore, South Korea, Hong Kong, and Taiwan), where massive investment in infrastructure and education facilitated an equally massive transformation of the economy in a very short period of time. South Korea, for example, lay in ruins at the climax of its civil war (1953), but has miraculously risen to a level of wealth similar to that of Italy. Another group of countries termed the BRICS (Brazil, Russia, India, China, and South Africa) fall outside of the Global North, but have experienced dramatic economic growth, raising its collective share of the global economy from 11% to 30% in just 25 years. Those countries continue to wield more political power in direct relation to the rise in economic might, and this could shift the economic, social, and political landscape of the world in the coming decades. Another group of NIC’s are the oil-rich Gulf States of Qatar, United Arab Emirates, Saudi Arabia, Kuwait, Iran, and possibly a few others. Such entities have accumulated massive amounts of wealth as a result of absolute advantage, the abundance of rare and high-valued commodities. Other countries enjoy absolute advantage due to climatic conditions for growing coffee, tobacco, tropical fruit, etc. The high price of oil and its concentrated supply, however, have facilitate massive economic growth in places that were traditionally poor and less developed than in recent years. Perhaps you are familiar with some of the recent development projects in this region of the world. The tallest building in the world (Burj Khalifa) and the world’s most ambitious set of artificial island construction projects are both located in the United Arab Emirates (UAE) (Figure 9.6) as evidence of the Gulf States development efforts in the 21st century.

Figure 9.6 | Annual Growth Rates in GDP, selected countries, 1996-2016

Author | The World Bank

Source | The World Bank

License | CC BY 4.0

In spite of the obvious wealth benefits that accrue in oil-rich or other resource- laden countries, they can also suffer what’s termed the Resource Curse (aka Dutch Disease), as the benefits of a highly valuable commodity do not spread to other members of society and violence/conflict emerge as groups fight over the resource. While income may be very high, millions of workers continue to face horrendous work conditions directly related to development efforts. In Qatar, for example, thousands of workers have died during the massive construction of new stadiums and other infrastructure required to host the World Cup in 2022. Other examples of Dutch Disease can be found in Nigeria (oil), South Africa (diamonds), and the Democratic Republic of Congo (coltan).

Figure 9.7a | Burj Khalifa, Dubai, United Arab Emirates

Author | User “Donaldytong”

Source | Wikipedia

License | CC BY SA 3.0

Figure 9.7b | Artificial Island Construction, Dubai, United Arab Emirates

Author | User “Lencer”

Source | Wikimedia Commons

License | CC BY SA 3.0

9.3.2 How Does a Country Improve Its Wealth and Well-Being?

The International Trade Model

The characteristics of this model are quite simple on the surface. In this strategy, a country embraces free trade (removing barriers to all imports and exports in a country) and willingly participates in all facets of the global economy. The basic benefits of the strategy are as follows:

- Potential High ROI (Return on Investment)

- Increased specialization leading to technological advantages

- Simplified development strategy

- Less government involvement

Libraries of books have been written about the transformative power of capitalism and other libraries of books have criticized the system. The international trade model asserts that trade between nations is the best way to bring about mutual prosperity for all. As a country removes barriers to trade, there will invariably be winners and losers, but classical macroeconomic (the branch of economics that focuses on entire systems rather than individuals or firms) theory posits that the overall benefit will be greater than the losses. The U.S. has championed the strategy since the end of WWII (1945) as it encouraged allies, neighbors, and adversaries to open borders, allow imports, and reduce controls on the free exchange of goods and services between countries. The European Union has done the same as it moved towards a common currency and a free flow of goods and services throughout Europe. The Asian Tigers and BRICS also embrace the global trade system to various degrees, having gained enormous growth in wealth following a recipe that calls for an intensive export-oriented economy.

Countries following the strategy remove domestic producer subsidies and allow global competition to decide the ‘winners’ and ‘losers’. As such, countries must find specific services and industries in which to gain specialization. South Korea, for example, elected to focus on low-end electronics initially before moving into other sectors such as ship-building and automobiles. Initially, the products were inferior to those produced elsewhere, but with each generation it improved its workforce, technical knowledge, and facilities until it gained a comparative advantage (ability to produce particular items/services more efficiently than competitors given all the alternatives) in those industries. Specialization requires a lot of practice with an intensity of focus, investment, and time to gain price and quality competitiveness on the global market, but if done correctly the rate of return on investment can be very high. For example, in the post-Korean War era (circa 1953), South Korea transitioned away from an economy based mostly on farming to become the 7th leading exporter in the world, specializing in cars, auto parts, ships, and integrated circuits. Moreover, the technological knowledge can then be used to foster other industries. Under this strategy, governments don’t try to protect certain companies over others, and since tariffs are removed, it simplifies the development strategy.

As countries gain comparative advantages in certain areas, they also tend to relinquish efforts in other areas. For example, as Japan focused developing its industrial sector after WWII, it focused less on agriculture, depending increasingly upon imports from other countries. Such a trade-off is termed opportunity cost in that choosing to do one thing prohibits you from doing something else. During the 1980’s era, the United States aggressively pursued an international trade model that allowed for more manufactured goods to be imported into the country. People working in areas like steel production, and coal mining began to see their job opportunities diminish as more foreign goods entered the U.S. economy. Proponents of the system argue that such workers need to adapt and become re-trained in other high paying professions in order to escape the pain that comes with economic transformation. Can you think of other industries or jobs that suffer as a result of a country’s choice to follow the international trade model?

A few other negative aspects to the strategy are:

- Susceptibility to unpredictable global markets

- Loss of local control

- Uneven benefits to the population.

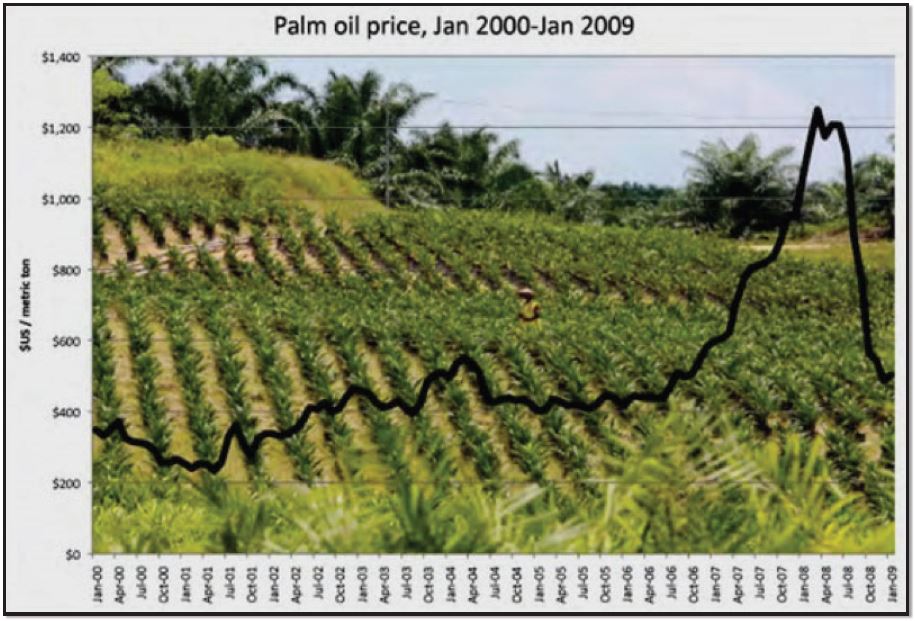

Take a look at Figure 9.8. The dramatic price shift (first upward and then downward) represents the dramatic risk associated with global trade. For a farmer that has shifted away from food production and into palm oil (as did millions of farmers in Indonesia and Malaysia in the 2000’s), this price drop is more than just economic theory. It can be the difference between living and dying. Focusing on a few key industries or products within a country comes with serious risks. What if prices drop unexpectedly or global preferences for certain products change without warning? Somebody gets left holding the bag and such shifts are very common in many commodity chains, with those at the bottom suffering the most serious consequences.

Figure 9.8 | Palm Oil Prices, 2000-2009

Author | Todd Lindley

Source | Original Work

License | CC BY SA 4.0

The second risk, loss of local control, occurs when countries have entered into free-trade agreements such as the North American Free Trade Agreement (NAFTA) between Mexico, the U.S., and Canada. As U.S. corporations increasingly began to re-locate production to Mexico, American workers’ calls for politicians to intervene went unanswered because the agreement prevented state or local governments from taking intentional actions to protect jobs or to keep companies from moving.

Finally, international trade has generated significant growth in production and wealth, but it also brings new competition that disrupts local economies. While customers usually benefit from lower prices of imported products, many local producers lose their livelihoods entirely. As the U.S. lost manufacturing jobs to Mexico, more than 2 million small-scale Mexican farmers also lost their jobs, as Mexican corn could not possibly compete with the low-cost, mass produced crops from the U.S. and Canada. Corn exports to Mexico in 2016 were 5 times higher than in the year before NAFTA. It is not an accident that rates of immigration from Mexico to the U.S. increased dramatically during the same period. As farmers lost their jobs, the moved in search of new ones.

The Protectionist Model

As you probably have guessed from its name, the protectionist model (also known as import substitution) requires that countries sustain themselves without significant trade with other countries. Protectionist policies are applied to safeguard domestic companies from foreign ones. The theory behind this strategy is grounded in the idea that over-reliance on foreign labor, products, and/or services can be detrimental to national sovereignty and/or security. As such, the strategy became very popular among countries that gained independence after many years of imperialism and colonization. India, Jamaica, the Philippines, the former Yugoslavia, the former Soviet Union, and most countries in the Caribbean and in Africa embarked up this strategy from the 1950’s-1980’s. Yugoslavia, for example, produced its own car, called a Yugo, and India did the same. These automobiles were designed to be affordable for domestic consumers, but in both cases the strategy failed to produce a reliable, affordable product and left consumers without access to better alternatives imported from Germany, Japan, or the U.S. Protectionism is closely tied to nationalism in many cases as politicians and/or consumers ask the basic question, “Why don’t we take care of ourselves, by ourselves, rather than depending on workers and producers from other parts of the world?” How does this question relate to your own opinions about whatever country you live in or were born in? Does the argument make sense to you?

By the 21st century, the vast majority of countries in the world turned away from protectionism as a strategy in favor or adopting an international trade oriented economy. Nonetheless, protectionism does offer certain advantages worthy of consideration such as:

- More controlled decision-making

- Benefits spread to more members of society

- More government involvement

- Food security

Decision-making by governments can be more controlled and policy decisions can be easier to make and policies can be designed to benefit and spread to more members of society under protectionism. Until 1993, for example, corn farmers in Mexico were protected from cheap corn produced in the U.S. and Canada, because of restrictions on imports. Most of the millions of small-scale corn farmers in Mexico could grow enough corn for their own families and produce a small surplus to be sold locally, providing a small but meaningful wage for millions of families. Protecting farmers from outside competition offered a measure of predictability, political stability, and food security from one year to the next. Mexico is also blessed with generous reserves of oil and traditionally the government has controlled domestic oil and gas prices, which again can bring a certain level of predictability to consumers as opposed to the wild shifts in prices that can often accompany imported oil.

Disadvantages to this isolationist strategy are probably apparent to you as you read and think about this topic. A few of them are listed here:

- Susceptibility to corruption, inefficiency, and slow response to market conditions

- Lacking in creativity and innovation

- Absence of natural resources in some places necessitate trade to meet demand

When a government protects a company from outside competition, there is a tendency for that company to become susceptible to corruption. Since 1938 a single oil company called Pemex had exclusive rights to drill, process, and sell oil within Mexico, which provided a huge source of revenue, protected jobs, and helped build national pride. In recent decades, however, the company increasingly found itself entangled in one scandal after another involving bribes, kickbacks, and various schemes that have kept gasoline prices at the pump artificially high. In 2013, however, Mexico began reforms known as market liberalization (a process of removing barriers to foreign-owned companies from operating and competing with domestic ones), allowing BP, Shell, and other companies to import petroleum and open gas stations in certain parts of Mexico. Such a shift is having a serious impact upon the national landscape both symbolically and materially as residents have a choice between competitors for the first time in 80 years!

Figure 9.9 | Nationally Owned/Operated Gas Stations in Mexico

Author | User “Diaper”

Source | Flickr

License | CC BY 2.0

Aside from corruption, another drawback to isolationism is the lack of creativity and innovation that otherwise comes from fierce competition. Venezuela, a country that has resisted international trade in favor of protectionism, currently is suffering from massive shortages in food and other necessary consumer items as domestic producers have failed to innovate and respond to consumer demand. Meanwhile, global supply chains of rice, beans, corn, tomatoes, mangoes, coffee, sriracha sauce, and fidget spinners have constantly evolved, innovated, and changed to efficiently provide for the demands of consumers internationally whether they happen to be in Sydney, Seoul, Santo Domingo, or Sao Paulo! It is very difficult for governments to plan for and anticipate the needs of an entire society for any length of time. Protectionism requires a government that can match consumers and producers efficiently, a task often handled much better by free-market forces than by public officials.

The final element that makes protectionism so problematic rests in simple geography. All countries have different conditions related to site, situation, climate, or natural resources, so trade isn’t just advantageous but rather it is essential to survival. An extreme case can be found in North Korea, a country with notoriously tightly controlled borders. Without trade the country routinely fails to produce enough rice, leaving millions desperate and undernourished. Likewise, China faced similar droughts, food shortages, and periods of starvation when it favored protectionism for most of the 20th century, but it began to reverse its strategy as it cautiously opened its economy to the rest of the world in the early 1980’s.

The 2 Models in Global Context

After reading the brief summaries of the 2 models above, you might ask yourself why any country would choose a protectionist model, given the obvious advantages and drawbacks of each. Most economists say the same thing. We need to exercise caution with overly simplistic conclusions, however. Here is where geography and history are worth careful consideration. Let’s begin with Caribbean islands (most of them anyway). The majority of Caribbean countries were colonies until just very recently (1960’s onward). During the colonial period, European powers established a monoculture (agricultural system heavily focused on a single item) plantation economic system in which particular islands or territories focused exclusively on one item such as sugar, bananas, or pineapple. Upon independence, many of these former colonies found that they had very little diversity in their own domestic economy, meaning that even after earning their freedom they were still almost entirely dependent upon the former colonizer economically because the plantation economy created a relationship of dependency. The concept of dependency theory explains the economic problems experienced by former colonies as a function of the disadvantageous terms and patterns of trade established over hundreds of years. Look at it this way. If all of the grocery stores around you closed permanently, would you be able to head into the wilderness tomorrow to find your own food? Would you know which berries are safe and which are poisonous? Probably not. This was the situation in which many former colonies found themselves, so it made sense for them to attempt to protect themselves from outside competition while domestic companies could emerge and develop. Moreover, world systems theory suggests that the global system of trade only works as long as there are a persistent set of winners (more developed countries), who mostly benefit from low-cost production in poor countries, and losers (less developed countries) that provide a readily available supply of laborers willing to work long hours for low wages.

While many countries have clearly benefitted from the international trade model, others have actually been damaged by their participation in global competition. Ethiopia’s largest export, for example, is coffee and although retail prices for a cup of coffee have increased dramatically, incomes of coffee farmers in that country have not reaped any of those benefits. Instead, prices paid for coffee beans have routinely been set by foreign commodities markets that tend to undervalue the product and harm small producers, leaving only large producers with a meaningful profit. Although just 3 cents more per kilo could bring these farmers out of poverty, global markets don’t account for such disparities. One remedy for such a complicate problem is fair trade, a system that guarantees a basic living wage for those at the very bottom of the global production cycle.

Another meaningful problem with global trade is that it can be very disruptive and unpredictable. Following years of state controlled markets, Russia began to open itself to foreign competition and free-market reforms after 1989. While Western countries applauded the decision, many people in Russia suffered as they experienced a lower quality of life, loss of jobs, and massive economic and political instability. Social problems, most notably high unemployment and alcohol abuse, began to dominate society as life expectancy actually dropped significantly for Russian men, many of whom could not adapt to the new demands of a fully market- based economy.

In summary, the decisions made by any country about the best path to increase development are not so clear. Leaders and policy-makers face very difficult, often contradictory decisions that vary from place to place, about how to make things better for citizens and residents. Moreover, what might be good in the short- term, can be problematic in the long-term. For example, Jamaica’s decision to protect its farmers from outside competition benefitted local farmers in the short- term, but the island government’s subsidies to farmers proved too costly for the government in the long term. When the money ran out, the country found itself in crisis. Collectivist societies are particularly threatened by international trade models in that many traditional forms of society do not encourage competition, but rather they value cooperation for the good of the group over the desires of any individual. Finally, any development strategy that values short-term benefits over long-term costs are clearly problematic. As India and China have embraced international trade, for example, unprecedented levels of air and water pollution have become the norm in Shanghai, Bombay, Delhi, and Beijing (among others). Sustainable Development is a strategy that balances both current and future benefits and costs and attempts to balance them with any possible environmental damage (e.g. oil spills, loss of habitat, erosion, increased pollution, dangerous waste) that might occur.