94 11.4 THE EXPANSION (AND EVENTUAL DECLINE) OF INDUSTRY

11.4.1 Transnational Corporations

Modern industry has become dominated by Transnational Corporations. Transnational Corporations (TNCs) have the ability to coordinate and control various processes and transactions within production networks, both within and between different countries. They also have the ability to take advantage of geographical differences of factors of production and state policies. Potential geographical flexibility for sales is a final benefit.

Foreign Direct Investment (FDI) is exactly what is sounds like. Companies invest in other countries. The usual narrative of this in the United States is simply offshoring for cheaper labor. The reality is more complicated. Just consider the examples above of the manufacturers who build facilities in the United States. They aren’t seeking cheap labor. America companies moving production may be seeking to tap into a large pool of labor, but that labor is not as cheap as it was 20 years ago. Another reason for investing in China is the same reason that other companies invest here in North America, to gain entry into a large market. Companies and individuals investing in other countries have numerous motivations. Some of these motivations are altruistic. There is no shortage of entities that seek to use FDI as a mechanism to alleviate poverty. The earlier critique of financial incentives applies directly of foreign direct investment, for obvious reasons. Poor and desperate places will sometimes make economic decisions that make little economic sense.

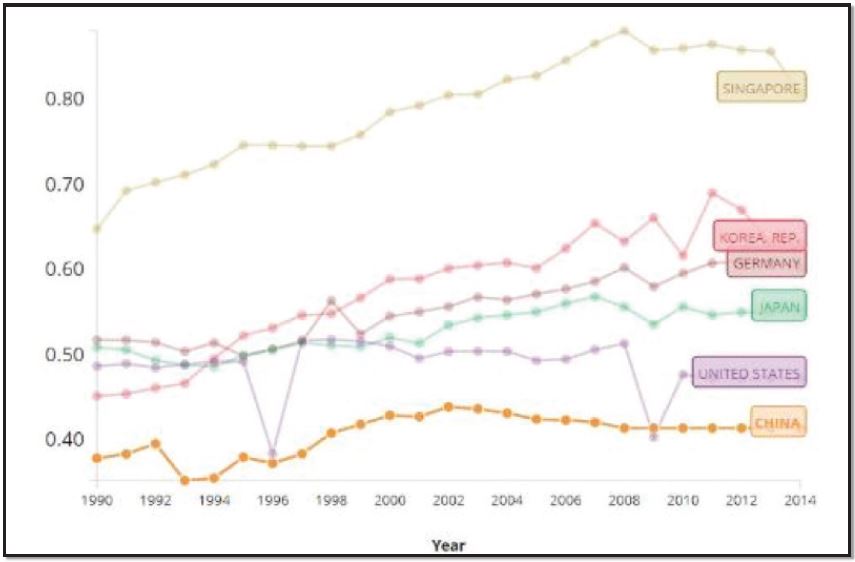

Figure 11.7 | Medium-Tech And High-Tech Manufacturing Value Added Share In Total Manufacturing

Author | The World Bank

Source | The World Bank

License | CC BY 4.0

FDI has an established history. Initially companies in wealthy countries were mostly interested in extracting raw materials from other, usually poorer, countries. This continues to this day. Countries like Niger, The Democratic Republic of Congo, and Venezuela function almost solely as a source of inputs for other companies based in other countries. Other places have seen investment in factories. Sometimes this is due to very low-cost labor, but in many instances, it is due to the fact that their wages are relatively low and they are relatively close to their market. An example of this was seen in Eastern Europe when many of these countries entered the European Union.

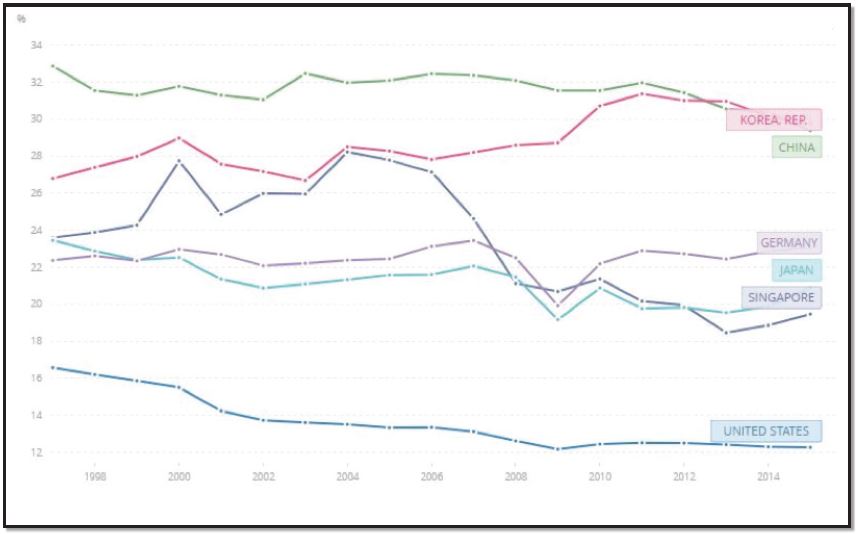

The next graph is slightly different. It shows the different trajectories of manufacturing in general as part of a countries economy. As you can see, manufacturing as a share of GPD in the United States has been quite low for some time. Manufacturing in China and Korea is much more important, but in both these places, the relative value of manufacturing is falling. In Germany, Japan and Singapore, the value of manufacturing is rising, although at very moderate levels. Note that neither of these graphs account for wages produced from manufacturing employment.

Figure 11.8 | Manufacturing Value Added Share In GDP

Author | The World Bank

Source | The World Bank

License | CC BY 4.0