Learning Objectives

The objectives of this section is to help students …

- Understand the sellers’ objectives in making pricing decisions

Pricing objectives

Firms rely on price to cover the cost of production, to pay expenses, and to provide the profit incentive necessary to continue to operate the business. We might think of these factors as helping organizations to: (a) survive, (b) earn a profit, (c) generate sales, (d) secure an adequate share of the market, and (e) gain an appropriate image

- Survival: It is apparent that most managers wish to pursue strategies that enable their organizations to continue in operation for the long term. So survival is one major objective pursued by most executives. For a commercial firm, the price paid by the buyer generates the firm’s revenue. If revenue falls below cost for a long period of time, the firm cannot survive.

- Profit: Survival is closely linked to profitability. Making a USD 500,000 profit during the next year might be a pricing objective for a firm. Anything less will ensure failure. All business enterprises must earn a longterm profit. For many businesses, long-term profitability also allows the business to satisfy their most important constituents–stockholders. Lower-than-expected or no profits will drive down stock prices and may prove disastrous for the company.

- Sales: Just as survival requires a long-term profit for a business enterprise, profit requires sales. As you will recall from earlier in the text, the task of marketing management relates to managing demand. Demand must be managed in order to regulate exchanges or sales. Thus marketing management’s aim is to alter sales patterns in some desirable way.

- Market share: If the sales of Safeway Supermarkets in the Dallas-Fort Worth metropolitan area of Texas, USA, account for 30 per cent of all food sales in that area, we say that Safeway has a 30 per cent market share. Management of all firms, large and small, are concerned with maintaining an adequate share of the market so that their sales volume will enable the firm to survive and prosper. Again, pricing strategy is one of the tools that is significant in creating and sustaining market share. Prices must be set to attract the appropriate market segment in significant numbers.

- Image: Price policies play an important role in affecting a firm’s position of respect and esteem in its community. Price is a highly visible communicator. It must convey the message to the community that the firm offers good value, that it is fair in its dealings with the public, that it is a reliable place to patronize, and that it stands behind its products and services.

Developing a pricing strategy

While pricing a product or service may seem to be a simple process, it is not. As an illustration of the typical pricing process, consider the following quote: “Pricing is guesswork. It is usually assumed that marketers use scientific methods to determine the price of their products. Nothing could be further from the truth. In almost every case, the process of decision is one of guesswork.” (2)

Good pricing strategy is usually based on sound assumptions made by marketers. It is also based on an understanding of the two other perspectives discussed earlier. Clearly, sale pricing may prove unsuccessful unless the marketer adopts the consumer’s perspective toward price. Similarly, a company should not charge high prices if it hurts society’s health. Hertz illustrates how this can be done in “Integrated marketing” below.

A pricing decision that must be made by all organizations concerns their competitive position within their industry. This concern manifests itself in either a competitive pricing strategy or a nonprice competitive strategy. Let us look at the latter first.

Nonprice competition

Nonprice competition means that organizations use strategies other than price to attract customers. Advertising, credit, delivery, displays, private brands, and convenience are all example of tools used in nonprice competition. Businesspeople prefer to use nonprice competition rather than price competition, because it is more difficult to match nonprice characteristics.

Figure 12.1: An example of nonprice competition.

Competing on the basis of price may also have a deleterious impact on company profitability. Unfortunately, when most businesses think about price competition, they view it as matching the lower price of a competitor, rather than pricing smarter. In fact, it may be wiser not to engage in price competition for other reasons. Price may simply not offer the business a competitive advantage (employing the value equation).

Competitive pricing

Once a business decides to use price as a primary competitive strategy, there are many well established tools and techniques that can be employed. The pricing process normally begins with a decision about the company’s pricing approach to the market.

Approaches to the market

Price is a very important decision criteria that customers use to compare alternatives. It also contributes to the company’s position. In general, a business can price itself to match its competition, price higher, or price lower. Each has its pros and cons.

Pricing to meet competition

Many organizations attempt to establish prices that, on average, are the same as those set by their more important competitors. Automobiles of the same size and having equivalent equipment tend to have similar prices. This strategy means that the organization uses price as an indicator or baseline. Quality in production, better service, creativity in advertising, or some other element of the marketing mix are used to attract customers who are interested in products in a particular price category.

The keys to implementing a strategy of meeting competitive prices are an accurate definition of competition and a knowledge of competitor’s prices. A maker of hand-crafted leather shoes is not in competition with mass producers. If he/she attempts to compete with mass producers on price, higher production costs will make the business unprofitable. A more realistic definition of competition for this purpose would be other makers of handcrafted leather shoes. Such a definition along with a knowledge of their prices would allow a manager to put the strategy into effect. Banks shop competitive banks every day to check their prices.

Pricing above competitors

Pricing above competitors can be rewarding to organizations, provided that the objectives of the policy are clearly understood and that the marketing mix is used to develop a strategy to enable management to implement the policy successfully.

Pricing above competition generally requires a clear advantage on some nonprice element of the marketing mix. In some cases, it is possible due to a high price-quality association on the part of potential buyers. Such an assumption is increasingly dangerous in today’s information-rich environment. Consumer Reports and other similar publications make objective product comparisons much simpler for the consumer. There are also hundreds of dot.com companies that provide objective price comparisons. The key is to prove to customers that your product justifies a premium price.

Pricing below competitors

While some firms are positioned to price above competition, others wish to carve out a market niche by pricing below competitors. The goal of such a policy is to realize a large sales volume through a lower price and profit margins. By controlling costs and reducing services, these firms are able to earn an acceptable profit, even though profit per unit is usually less.

Such a strategy can be effective if a significant segment of the market is price-sensitive and/or the organization’s cost structure is lower than competitors. Costs can be reduced by increased efficiency, economics of scale, or by reducing or eliminating such things as credit, delivery, and advertising. For example, if a firm could replace its field sales force with telemarketing or online access, this function might be performed at lower cost. Such reductions often involve some loss in effectiveness, so the tradeoff must be considered carefully.

Historically, one of the worst outcomes that can result from pricing lower than a competitor is a “price war”. Price wars usually occur when a business believes that price-cutting produces increased market share, but does not have a true cost advantage. Price wars are often caused by companies misreading or misunderstanding competitors. Typically, price wars are over reactions to threats that either are not there at all or are not as big as they seem.

Another possible drawback when pricing below competition is the company’s inability to raise price or image. A retailer such as K-mart, known as a discount chain, found it impossible to reposition itself as a provider of designer women’s clothiers. Can you imagine Swatch selling a USD 3,000 watch?

How can companies cope with the pressure created by reduced prices? Some are redesigning products for ease and speed of manufacturing or reducing costly features that their customers do not value. Other companies are reducing rebates and discounts in favor of stable, everyday low prices (ELP). In all cases, these companies are seeking shelter from pricing pressures that come from the discount mania that has been common in the US for the last two decades.

New product pricing

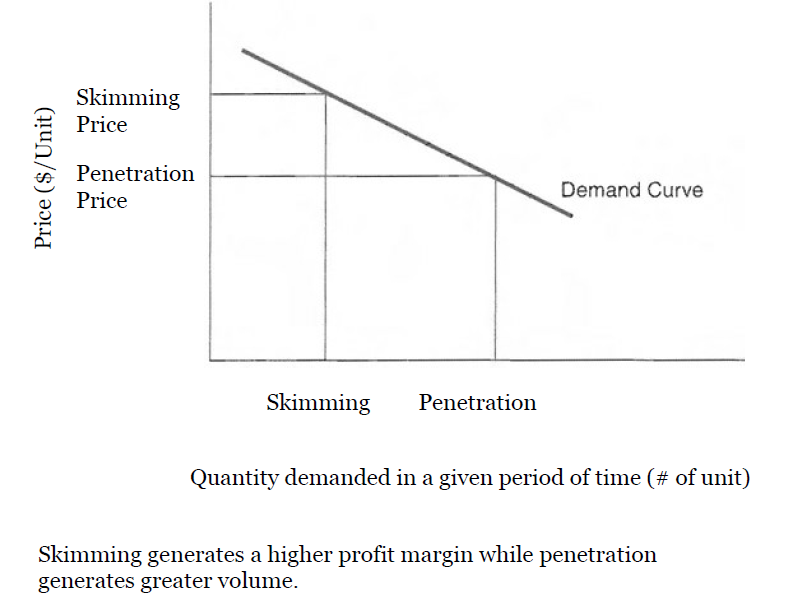

A somewhat different pricing situation relates to new product pricing. With a totally new product, competition does not exist or is minimal. What price level should be set in such cases? Two general strategies are most common: penetration and skimming. Penetration pricing in the introductory stage of a new product’s life cycle means accepting a lower profit margin and to price relatively low. Such a strategy should generate greater sales and establish the new product in the market more quickly. Price skimming involves the top part of the demand curve. Price is set relatively high to generate a high profit margin and sales are limited to those buyers willing to pay a premium to get the new product (see Figure 12.2).

Which strategy is best depends on a number of factors. A penetration strategy would generally be supported by the following conditions: price-sensitive consumers, opportunity to keep costs low, the anticipation of quick market entry by competitors, a high likelihood for rapid acceptance by potential buyers, and an adequate resource base for the firm to meet the new demand and sales.

Figure 12.2 : Penetration and skimming: pricing strategies as they relate to the demand curve.

A skimming strategy is most appropriate when the opposite conditions exist. A premium product generally supports a skimming strategy. In this case, “premium” does not just denote high cost of production and materials; it also suggests that the product may be rare or that the demand is unusually high. An example would be a USD 500 ticket for the World Series or an USD 80,000 price tag for a limited-production sports car. Having legal protection via a patent or copyright may also allow for an excessively high price. Intel and their Pentium chip possessed this advantage for a long period of time. In most cases, the initial high price is gradually reduced to match new competition and allow new customers access to the product.

Integrated Marketing

How to select the best price

The Hertz Corporation knows when its rental cars will be gone and it knows when the lots will be full. How? By tracking demand throughout past six years. “We know, based on past performance and seasonal changes, what times of year there is a weak demand, and when there is too much demand for our supply of cars,” says Wayne Meserue, director of pricing and yield management at Hertz. To help strike a balance, the company uses a pricing strategy called “yield management” that keeps supply and demand in check. The strategy looks at two aspects of Hertz’s pricing: the rate that is charged and the length of the rental.

“Price is a legitimate rationing device,”says Meserue. “What we’re really talking about is efficient distribution, pricing, and response in the marketplace.” For example, there are times when cars are in great demand. “It’s always a gamble, but it’s definitely a calculated gamble. With yield management, we monitor demand day by day, and adjust (prices as necessary),” Meserue says. Hertz also uses length of rental as a yield management device. For instance, in the US they established a three-night minimum for car rentals during President’s Day weekend in February. “We didn’t want to be turning away business for someone who wanted the car for five nights just because we had given our cars to people who came in first for one night,” says Meserue, who adds that it is often better for Hertz to mandate a minimum number of days for a rental, because it ensures that cars will be rented for more days.

A smart pricing strategy is essential for increasing profit margins and reducing supply. Yet at last count, only 15 per cent of large corporations were conducting any sort of pricing research, reports Robert Dolan, professor at Harvard Business School. “People don’t realize that if you can raise your prices by just 1 percent, that’s a big increase in your profit margin,” he says. For example, if a supermarket is operating with a 2 per cent net margin, raising the prices by 1 per cent will increase profitability by 33 per cent. “The key is not taking one percent across the board, but raising it 10 per cent for 10 per cent of your customers,” says Dolan, “Find those segments of the market that are willing to take the increase.” That doesn’t mean that companies can automatically pass their cost increases on the customer, notes Dolan. If the costs are affecting an entire industry, then those costs can be passed through easily to the consumer, because competitors will likely follow the lead.

A fundamental point in smart pricing, according to Dolan: base prices on the value to the customer. As much as people talk about customer focus, they often price according to their own costs, companies can profit from customizing prices to different customers. The value of a product can vary widely depending on factors such as age and location. (33)

Price lines

You are already familiar with price lines. Ties may be priced at USD 15, USD 17, USD 20, and USD 22.50; bluejeans may be priced at USD 30, USD 32.95, USD 37.95, and USD 45. Each price must be far enough apart so that buyers can see definite quality differences among products. Price lines tend to be associated with consumer shopping goods such as apparel, appliances, and carpeting rather than product lines such as groceries. Customers do very little comparison-shopping on the latter.

Price lining serves several purposes that benefit both buyers and sellers. Customers want and expect a wide assortment of goods, particularly shopping goods. Many small price differences for a given item can be confusing. If ties were priced at USD 15, USD 15.35, USD 15.75, and so on, selection would be more difficult; the customer could not judge quality differences as reflected by such small increments in price. So, having relatively few prices reduces the confusion.

From the seller’s point of view, price lining holds several benefits. First, it is simpler and more efficient to use relatively fewer prices. The product/service mix can then be tailored to selected price points. Price points are simply the different prices that make up the line. Second, it can result in a smaller inventory than would otherwise be the case. It might increase stock turnover and make inventory control simpler. Third, as costs change, either increasing or decreasing the prices can remain the same, but the quality in the line can be changed. For example, you may have bought a USD 20 tie 15 years ago. You can buy a USD 20 tie today, but it is unlikely that today’s USD 20 tie is of the same fine quality as it was in the past. While customers are likely to be aware of the differences, they are nevertheless still able to purchase a USD 20 tie. During inflationary periods the quality/price point relationship changes. From the point of view of salespeople, offering price lines will make selling easier. Salespeople can easily learn a small number of prices. This reduces the likelihood that they will misquote prices or make other pricing errors. Their selling effort is therefore more relaxed, and this atmosphere will influence customers positively. It also gives the salesperson flexibility. If a customer cannot afford a USD 2,800 Gateway system, the USD 2,200 system is suggested.

Price flexibility

Another pricing decision relates to the extent of price flexibility. A flexible pricing policy means that the price is bid or negotiated separately for each exchange. This is a common practice when selling to organizational markets where each transaction is typically quite large. In such cases, the buyer may initiate the process by asking for bidding on a product or service that meets certain specifications. Alternatively, a buyer may select a supplier and attempt to negotiate the best possible price. Marketing effectiveness in many industrial markets requires a certain amount of price flexibility.

Discounts and allowances

In addition to decisions related to the base price of products and services, marketing managers must also set policies related to the use of discounts and allowances. There are many different types of price reductions–each designed to accomplish a specific purpose.

Quantity discounts are reductions in base price given as the result of a buyer purchasing some predetermined quantity of merchandise. A noncumulative quantity discount applies to each purchase and is intended to encourage buyers to make larger purchases. This means that the buyer holds the excess merchandise until it is used, possibly cutting the inventory cost of the seller and preventing the buyer from switching to a competitor at least until the stock is used. A cumulative quantity discount applies to the total bought over a period of time. The buyer adds to the potential discount with each additional purchase. Such a policy helps to build repeat purchases. Building material dealers, for example, find such a policy quite useful in encouraging builders to concentrate their purchase with one dealer and to continue with the same dealer over time. It should be noted that such cumulative quantity discounts are extremely difficult to defend if attacked in the courts.

Figure 12.3: A rebate can be a very effective price discount.

Seasonal discounts are price reductions given or out-of-season merchandise. An example would be a discount on snowmobiles during the summer. The intention of such discounts is to spread demand over the year. This can allow fuller use of production facilities and improved cash flow during the year. Electric power companies use the logic of seasonal discounts to encourage customers to shift consumption to off-peak periods. Since these companies must have production capacity to meet peak demands, the lowering of the peak can lessen the generating capacity required.

Cash discounts are reductions on base price given to customers for paying cash or within some short time period. For example, a 2 per cent discount on bills paid within 10 days is a cash discount. The purpose is generally to accelerate the cash flow of the organization.

Trade discounts are price reductions given to middlemen (e.g. wholesalers, industrial distributors, retailers) to encourage them to stock and give preferred treatment to an organization’s products. For example, a consumer goods company may give a retailer a 20 per cent discount to place a larger order for soap. Such a discount might also be used to gain shelf space or a preferred position in the store.

Personal allowances are similar devices aimed at middlemen. Their purpose is to encourage middlemen to aggressively promote the organization’s products. For example, a furniture manufacturer may offer to pay some specified amount toward a retailer’s advertising expenses if the retailer agrees to include the manufacturer’s brand name in the ads.

Integrated Marketing

Beam me up, Scotty!

You remember William Shatner, a.k.a. Captain James T Kirk. As Kirk, he represented the epitome of integrity and professionalism. Death was better than compromise. Yet, here he is doing rather strange TV ads for Priceline.com Inc. Why? Probably because he is being paid a ton of money, and he is having fun. Working for an apparent winner is also exciting.

We say “apparent” because transferring Priceline’s patented “name your own price” system of selling airline tickets, groceries, cars, gasoline, telephone minutes, and a raft of other products is proving quite difficult. Complicating matters, several airlines and hotels are studying whether to launch Web services that could cut the legs out from under Priceline’s established travel businesses. Priceline could soon face stiff competition from its own suppliers. Hyatt, Marriott, Starwood, and Cendant–most of which sell excess hotel rooms through Priceline–are having serious discussions about starting their own company to distribute over the Internet. Essentially, these chains worry that by handing sales to Priceline, they could lose control of their customers. Several airlines have the same concerns.

To stay one step ahead, Priceline has decided to introduce 18 new products. Initially, Priceline generated 90 per cent of its revenues from airline tickets, rental cars, and hotel rooms. By 2003, Priceline estimates that only 50 per cent of revenues will come from these sources.

By June 2000, users were able to name their price for long distance phone service, gasoline, and cruises. At the end of 2000, Priceline.com started selling blocks of long-distance phone time to small companies. Later, it will offer them ad space, freight services, and office equipment. New joint ventures are in the works with companies in Hong Kong, Australia, Japan, Europe, and Latin America.

Executives at Priceline say they are on the right track and that they are building a broad-based discounting powerhouse. (35)

Some manufacturers or wholesalers also give prize money called spiffs for retailers to pass on to the retailer’s sales clerks for aggressively selling certain items. This is especially common in the electronics and clothing industries, where it is used primarily with new products, slow movers, or high margin items.

Trade-in allowances also reduce the base price of a product or service. These are often used to allow the seller to negotiate the best price with a buyer. The trade-in may, of course, be of value if it can be resold. Accepting trade-ins is necessary in marketing many types of products. A construction company with a used grader worth USD 70,000 would not likely buy a new model from an equipment company that did not accept trade-ins, particularly when other companies do accept them.

Price bundling

A very popular pricing strategy, price bundling, is to group similar or complementary products and to charge a total price that is lower if they were sold separately. Comcast, Direct TV, and Telstra all follow this strategy by combining different products and services for a set price. Customers assume that these computer experts are putting together an effective product package and they are paying less. The underlying assumption of this pricing strategy is that the increased sales generated will more than compensate for a lower profit margin. It may also be a way of selling a less popular product by combining it with popular ones. Clearly, industries such as financial services and telecommunications are big users of this.

Psychological aspects of pricing

Price, as is the case with certain other elements in the marketing mix, appears to have meaning to many buyers that goes beyond a simple utilitarian statement. Such meaning is often referred to as the psychological aspect of pricing. Inferring quality from price is a common example of the psychological aspect. A buyer may assume that a suit priced at USD 500 is of higher quality than one priced at USD 300. From a cost-of-production, raw material, or workmanship perspective, this may or may not be the case. The seller may be able to secure the higher price by nonprice means such as offering alterations and credit or the benefit to the buyer may be in meeting some psychological need such as ego enhancement. In some situations, the higher price may be paid simply due to lack of information or lack of comparative shopping skills. For some products or services, the quantity demanded may actually rise to some extent as price is increased. This might be the case with an item such as a fur coat. Such a pricing strategy is called prestige pricing.

Products and services frequently have customary prices in the minds of consumers. A customary price is one that customers identify with particular items. For example, for many decades a five-stick package of chewing gum cost USD 0.05 and a six-ounce bottle of Coca-Cola cost USD 0.05. Candy bars now cost 60 cents or more, a customary price for a standard-sized bar. Manufacturers tend to adjust their wholesale prices to permit retailers in using customary pricing. However, as we have witnessed during the past decade, prices have changed so often that customary prices are weakened.

Figure 12.4: Winning an award is a psychological aspect of price

Another manifestation of the psychological aspects of pricing is the use of odd prices 3 We call prices that end in such digits as 5, 7, 8, and 9 “odd prices” (e.g. USD 2.95, USD 15.98, or USD 299.99). Even prices are USD 3, USD 16, or USD 300. For a long time marketing people have attempted to explain why odd prices are used. It seems to make little difference whether one pays USD 29.95 or USD 30 for an item. Perhaps one of the most often heard explanations concerns the psychological impact of odd prices on customers. The explanation is that customers perceive even prices such as USD 5 or USD 10 as regular prices. Odd prices, on the other hand, appear to represent bargains or savings and therefore encourage buying. There seems to be some movement toward even pricing; however, odd pricing is still very common. A somewhat related pricing strategy is combination pricing. Examples are two-for-one, buy-one-get-one-free. Consumers tend to react very positively to these pricing techniques.

Review

- Pricing objectives:

- survival

- profit

- sales

- market share

- image

- Developing a pricing strategy:

- nonprice competition

- competitive pricing

- New product pricing:

- penetration

- skimming

- Price lining means a number of sequential price points are offered within a product category.

- Price flexibility allows for different prices charged for different customers and/or under different situations.

- Price bundling groups similar or complementary products and charges a total price that is lower than if they were sold separately.

- Certain pricing strategies, such as prestige pricing, customary pricing, or odd pricing, play on the psychological perspectives of the consumer.